owners draw report in quickbooks online

Click Save Close. Smith Draws Post checks to draw account.

419 412i Captive And Section 79 Plans Continue To Draw Irs Attention 412i Irs 6707 Section 79 Plan 419 Quickbooks Cost Of Goods Sold Irs

For a custom setup manually enter dates in the From and To fields.

. Enter the account name Owners Draw is recommended and description. To create an owners draw account. To change them click the arrow in the Date field on the Profit Loss report and choose the time period you want.

Select the Bank Account Cash Account or Credit Card you used to make the purchase. Category Type Equity. So whenever you transfer money to cover other things from your staff to your business thats Owners Contribution.

Open the chart of accounts use run report on that account from the drop down arrow far right of the account name. Go to Banking Write Checks. Httpintuitme2PyhgjfIn this QuickBooks Payroll tutoria.

Enter and save the information. Owners Draw via direct deposit using QuickBooks Online new electronic bill pay feature youtube bookkeeping quickbooksonline. At the bottom left choose Account New.

How do you record ownership of a distribution. Owners draws are usually taken from your owners equity account. Enter the Amount.

An owners draw also called a draw is when a business owner takes funds out of their business for personal use. Open the chart of accounts and choose Add Add a new Equity account and title it Owners Draws If there is more than one owner make separate draw accounts for each owner and name them by owner eg. Owner S Draw Quickbooks Tutorial How To Read Your Quickbooks Online Profit Loss Report Deximal How To Setup And Use Owners Equity In Quickbooks Pro Youtube How To Pay Invoices Using Owner S Draw Quickbooks Online Tutorial Part 18 Viewing And Creating Reports Youtube Owners Draw Balances.

If youre a sole proprietor you must be paid with an owners draw instead of employee paycheck. While logged in to your Quickbooks account click the Lists link at the top of the main menu. Expenses VendorsSuppliers Choose New.

In QuickBooks Online Click on the sign that is New option Choose the option Bank Deposit Click on the Account drop-down arrow Choose the bank account in which you want to deposit the money Mention the date of the action in the Date column. How do I report an owners draw in QuickBooks. From the PAY TO THE ORDER OF field select the vendors name.

Select Owners Equity from the Detail Type drop-down. Details Choose Lists Chart of Accounts or press CTRL A on your keyboard. For example at the end of an accounting year Eve Smiths drawing account has accumulated a debit balance of 24000.

2 Create an equity account and categorize as Owners Draw. At the bottom left choose Account New. How to Record Investments done by the owner after setting up and Pay the Owners draw in QuickBooks Online.

An owners draw is when an owner takes money out of the business. You can find owners equity or investments and owners draws listed in an equity account. At the bottom of the Chart of Accounts page you should see an option titled Accounts click it and choose New.

Business owners might use a draw for compensation versus paying themselves a salary. Enter the account name Owners Draw is recommended and description. Click Save Close.

Select Equity and Continue. Setting Up an Owners Draw Before you can record an owners draw youll first need to set one up in your Quickbooks account. A members draw also known as an owners draw or a partners draw is a quickbooks account that records the amount taken out of a company by one of its owners along with the amount of the owners investment and the.

Select Save and Close. Would you simply categorize payments to this person as Owners Draw. Search for the owners pay.

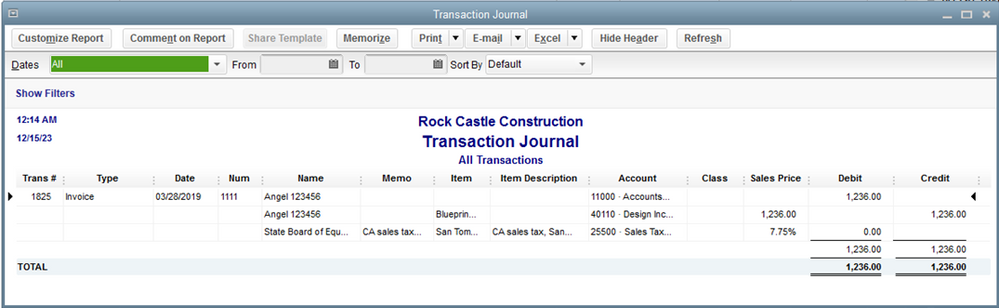

How do I show owner pay in QuickBooks. A journal entry closing the drawing account of a sole proprietorship includes a debit to the owners capital account and a credit to the drawing account. An owners draw account is an equity account used by QuickBooks Online to track withdrawals of the companys assets to pay an owner.

Select Equity from the Account Type drop-down. Owners contribution is any time you pay for business expenses with personal funds or transfer personal funds to a business bank account. QuickBooks Online In years past the business had a contractor who the owner married and for tax year 2021 they are business partners.

To create an Equity account. Visit the Lists option from the main menu followed by Chart of Accounts. For a company taxed as a sole proprietor or partnership I recommend you have the following for ownerpartner equity accounts one set for each partner if a partnership October 15 2018 05.

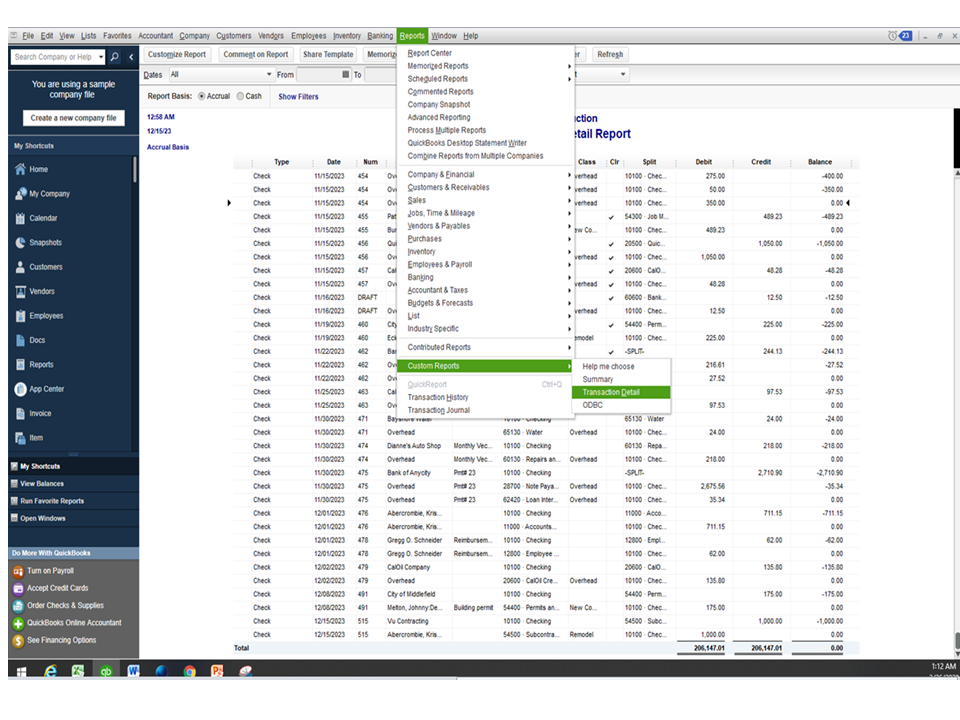

This tutorial will show you how to record an owners equity draw in QuickBooks OnlineIf you have any questions please feel free to ask. Check the dates on your report. From the QuickBooks Reports menu choose Company Financial and then choose Profit Loss Standard.

October 15 2018 0559 PM. An owners draw account is an equity account used by quickbooks online to track withdrawals of the companys assets to pay an owner. Set up and pay a draw for the owner.

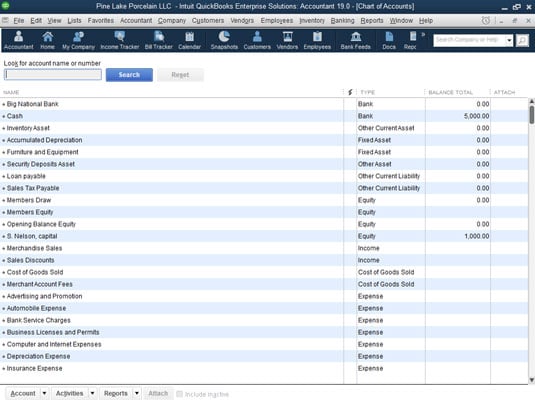

How to Create an Equity Account. Learn more about owners draw vs payroll salary and how to pay yourself as a small business owner. Select Chart of Account under Settings.

Owners equity is made up of different funds including money youve. Enter an opening balance. You can create an equity account by accessing the Chart of Accounts feature in Quickbooks Desktop.

Report this post The most highly requested video on my channel. Select New in the Chart of Accounts window. With QuickBooks Online you can record personal money you use to pay bills or start your business.

How do I show owners draw in Quickbooks. Its quite literally the exact opposite of Owners Draw. Click Equity Continue.

Choose Lists Chart of Accounts or press CTRL A on your keyboard. Click Equity Continue. Click the Expenses tab and then select the account category that best fits your needs.

Typically this would be a sole proprietorship or LLC where the business and the owner are considered the same for. Accountants call this a capital investmentThese funds come from you as an owner partners or other ownersHeres how to track adding capital how to see the total at any time and how to repay an investment. Select the Gear icon at the top and then select Chart of Accounts.

1 Create each owner or partner as a VendorSupplier. Select the Gear icon at the top then Chart of Accounts. Heres how to do it.

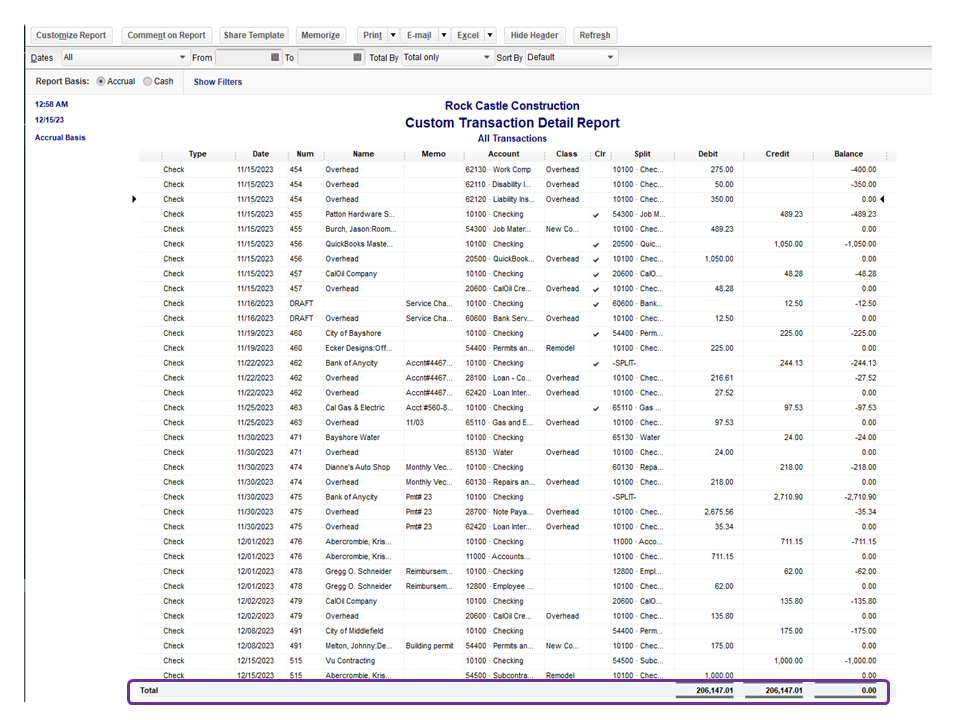

Solved Transaction Detail By Account Report

How To Read Your Quickbooks Online Profit Loss Report Deximal

Why Is My Quickbooks Profit And Loss Report Not Showing Owner S Draw Quickbooks Tutorial

Solved Transaction Detail By Account Report

How To Automatically Send Accounting Reports Through Email Quickbooks Online Tutorial Youtube

Solved How Do I Get Totals To Show Up On A Check Detail R

How To Set Up The Quickbooks 2019 Chart Of Accounts List Dummies

Minutes Matter In The Loop Paying Amp Reimbursing Yourself In Quickbooks Chart Of Accounts Quickbooks Accounting

Onpay Payroll Services Review Payroll Software Payroll Advertising Methods

Quickbooks Owner Draws Contributions Youtube

Solved How Do I Get Totals To Show Up On A Check Detail R

Quickbooks Help How To Create A Check Register Report In Quickbooks Inside Quick Book Reports Templates Great Cre Quickbooks Help Quickbooks Check Register

Report Only Users In Quickbooks Online Youtube

Salary Vs Owner S Draw How To Pay Yourself As A Business Owner 2021 Small Business Consulting Consulting Business Business Management Degree

Double Entry Accounting Has Come To Freshbooks Small Business Accounting Accounting Double Entry