are new hampshire property taxes high

If you want to move to New Hampshire but dont want to pay high property taxes Carroll County may. The real estate transfer tax is also commonly referred to as stamp tax mortgage registry tax and deed tax.

My Property Taxes Are What Understanding New Hampshire S Property Tax Milestone Financial Planning

Although the Department makes every effort to ensure the accuracy of data and information.

. The Center Square A new study shows New Hampshire ranks third highest in the country for high property taxes. WalletHub determined which states had the highest and lowest property taxes by comparing all 50 states and the District of Columbia by using US. Understanding Property Taxes in New Hampshire.

186 Median home value. Todays map shows states rankings on the property tax component of the 2019 State Business Tax Climate Index. The Index s property tax component evaluates state and local taxes on real and personal property net worth and asset transfers.

The citizens of New Hampshire pay a higher percentage of income in property tax 56 percent than any other state. New Hampshire and New Jersey naturally follow with per capita property taxes of 3310 and 3277. New Hampshire has the second-highest property taxes per capita in the nation.

The combination of a high median household income ranked 6 in 2018 and low individual tax burden creates conditions for residents to thrive. 2021 New Hampshire Property Tax Rates. 4636 3rd of 50 634 2nd of 50 186 2nd of 50.

Click here for a map of New Hampshire property tax rates. Then oddly freely admit that they pay more taxes where they. Which NH towns have the highest property taxes.

In Claremont for example the property tax rate is 41 per 1000 of assessed value while in Auburn its only around 21 per 1000 of assessed value. Property tax rates the other New England states were. Census data and by applying assumptions based on national auto sales data for vehicle property taxes.

This states transfer tax is 075 of the sale paid by both buying and selling parties for a total aggregate of 15. August 3 2018. A new study shows New Hampshire ranks third highest in the country for high property taxes.

The buyer cant deduct this. Per Capita Property Tax. By Porcupine Real Estate Oct 4 2017 Real Estate.

Counties in New Hampshire collect an average of 186 of a propertys assesed fair market value as property tax per year. New Hampshire Taxes as percentage of home value. The citizens of New Hampshire pay a higher percentage of income.

And Gloucester and Salem rank high in property taxes as well at No. Data and information contained within spreadsheets posted to the internet by the Department of Revenue Administration Department is intended for informational purposes only. When combining all local county and state property taxes these towns have the highest property tax rates in New Hampshire as of January 1 2022.

New Hampshires median home value of 252800 is the 12th. The Center Square A new study shows New Hampshire ranks third highest in the country for high property taxes. Yes New Hampshire is a low tax state.

New Hampshires real estate transfer tax is very straightforward. WalletHub determined which states had the highest and lowest property taxes by comparing all 50 states and the District of Columbia by using US. Claremont 4098 Berlin 3654.

Property tax rates vary widely across New Hampshire which can be confusing to house hunters. State Education Property Tax Warrant. According to findings released by financial website WalletHub the state has a 218 tax rate with consumers paying 5701 in real estate taxes on a home with a.

New Hampshire has one of the highest average property tax rates in the country with only two states levying. Answer 1 of 6. New Hampshire Property Taxes.

A county tax a town tax a local school tax and the state education tax. Consequently New Hampshire has the lowest percentage of residents. The ability to choose ones property tax rate makes New Hampshire an appealing option for those who value liberty and low taxes.

And I have this discussion with family members often. The median property tax in New Hampshire is 463600 per year for a home worth the median value of 24970000. Click here to learn more about property taxes in New Hampshire including the latest bills to change property taxes.

In fact any given property can pay up to four different property taxes. Er it is a lower tax state than many others. Who complain they cant move to New Hampshire because the taxes are too high.

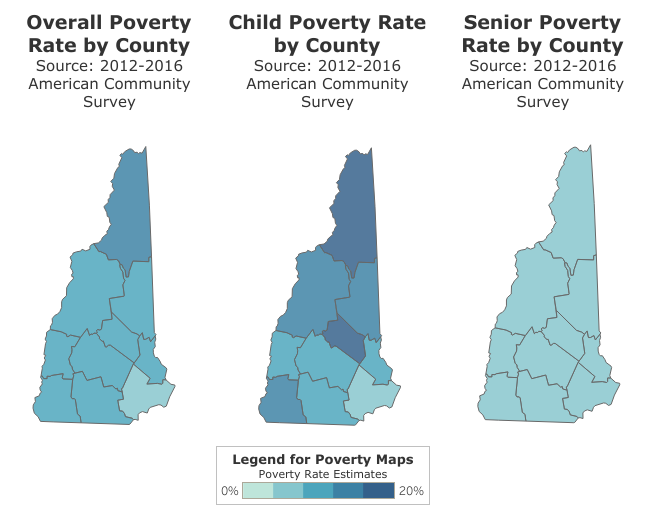

For more localized statistics you can find your county in the New Hampshire property tax map or county list found on this page. The property tax component accounts for 154 percent of each states overall Index score. New Hampshire is also third highest when the state median home value is considered.

Connecticut is the only other state whose per capita property tax by state is over 3000 3020. Census data and by applying assumptions based on national auto sales data for. New Hampshire has both state and local property taxes.

Maine 14 and Massachusetts 12. Map of New Hampshire 2021 Property Tax Rates - See Highest and Lowest NH Property Taxes. The myth in New Hampshire is that we run the state on sin taxes cigarettes alcohol and gambling.

How New Hampshire Property Taxes Work. Percentage Of Property Value. The Bramber Green neighborhood is seen in Greenland New Hampshire.

Connecticut with a 21 rate is almost as high as New Hampshire. New Hampshire has the second-highest property taxes per capita in the nation behind New Jersey. Leads the way in the property tax per capita by state category with 3500.

What Would It Look Like If New Hampshire Actually Seceded From The U S Nh Business Review

Nh Where Rich Towns Like Rye Get Richer And Poor Ones Like Berlin Need Help Indepthnh Orgindepthnh Org

Is New Hampshire Really As Anti Tax As It S Cracked Up To Be Stateimpact New Hampshire

States With The Highest Property Taxes Gobankingrates

10 Pros And Cons Of Living In New Hampshire Right Now Dividends Diversify

New Hampshire Property Tax Calculator Smartasset

Historical New Hampshire Tax Policy Information Ballotpedia

New Hampshire Property Tax Calculator Smartasset

Understanding New Hampshire Taxes Free State Project

10 Best Places To Retire In New Hampshire Smartasset

What You Should Know About Moving To Nh From Ma

Property Taxes On Owner Occupied Housing By State Tax Foundation Infographic Map Real Estate Infographic Map

Understanding New Hampshire Taxes Free State Project

2022 Best Places To Buy A House In New Hampshire Niche

How We Fund Public Services In New Hampshire New Hampshire Municipal Association

How Much Does Your State Collect In Sales Taxes Per Capita Sales Tax Tax State Tax

Statewide Education Property Tax Change Provides Less Targeted Relief New Hampshire Fiscal Policy Institute

Cost Of Living In New Hampshire Taxes Housing More Upgraded Home