nebraska car sales tax form

Nebraska Department of Revenue Form 6 is not available for download from the Department of Motor Vehicles website. Unlike for an Application for Duplicate Title a husband.

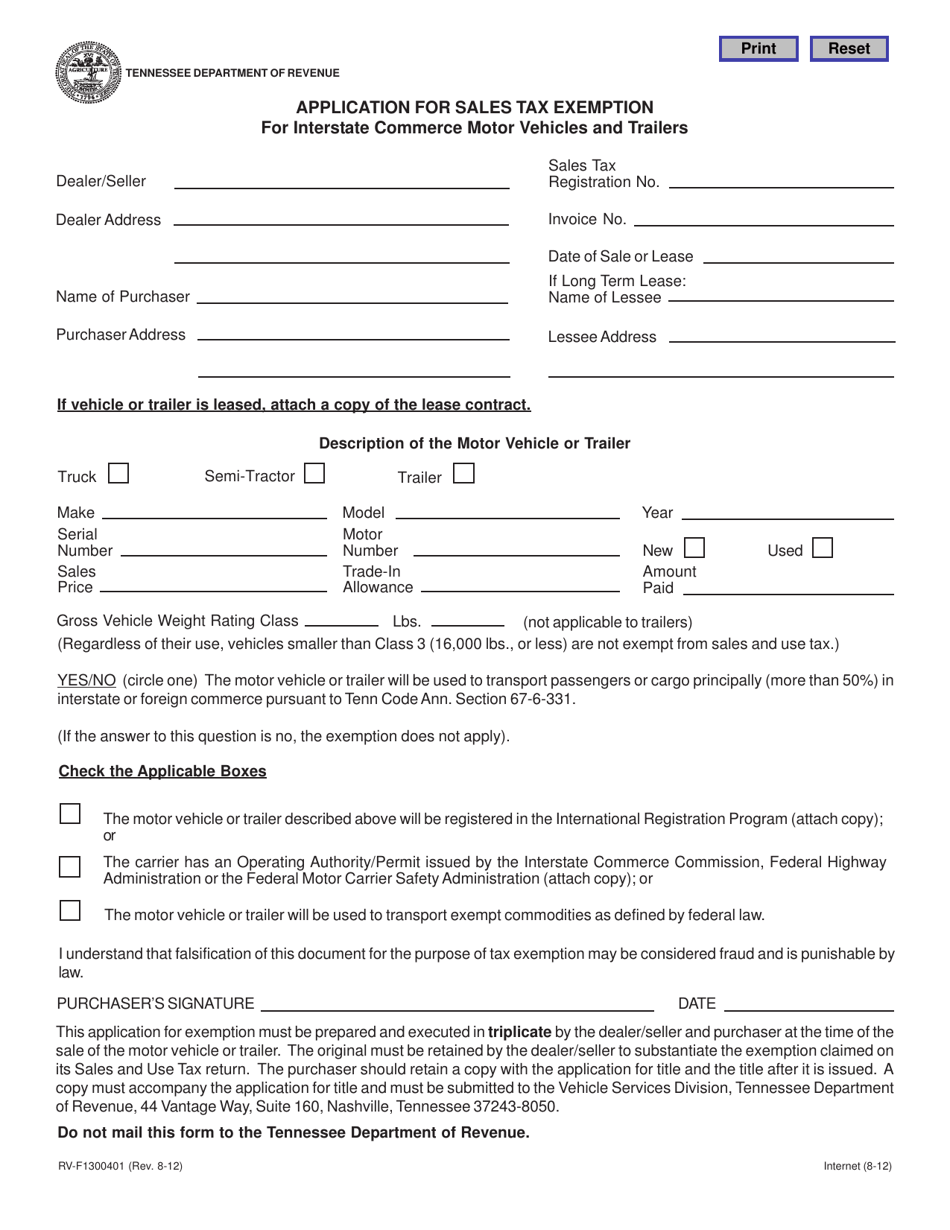

Form Rv F1300401 Download Fillable Pdf Or Fill Online Application For Sales Tax Exemption For Interstate Commerce Motor Vehicles And Trailers Tennessee Templateroller

C As an Option 1 or Option 3 contractor I hereby certify that the purchase of building materials and fixtures from the seller listed above are exempt from Nebraska sales tax.

. IRS Form W-9 Request for Taxpayer Identification Number and Certification. Information regarding Nebraska Drivers Licenses IDs or permits. Purchase of building materials or fixtures.

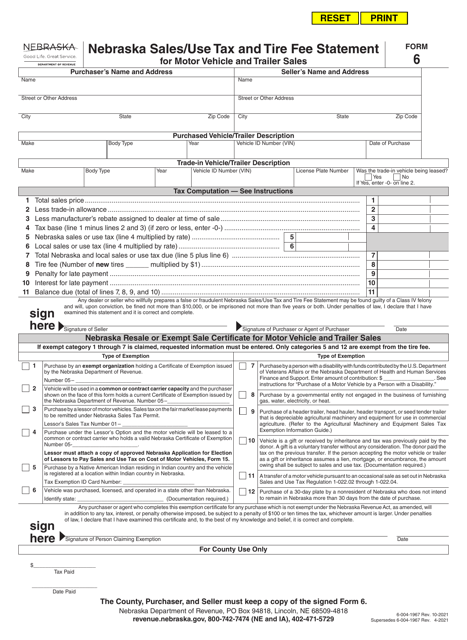

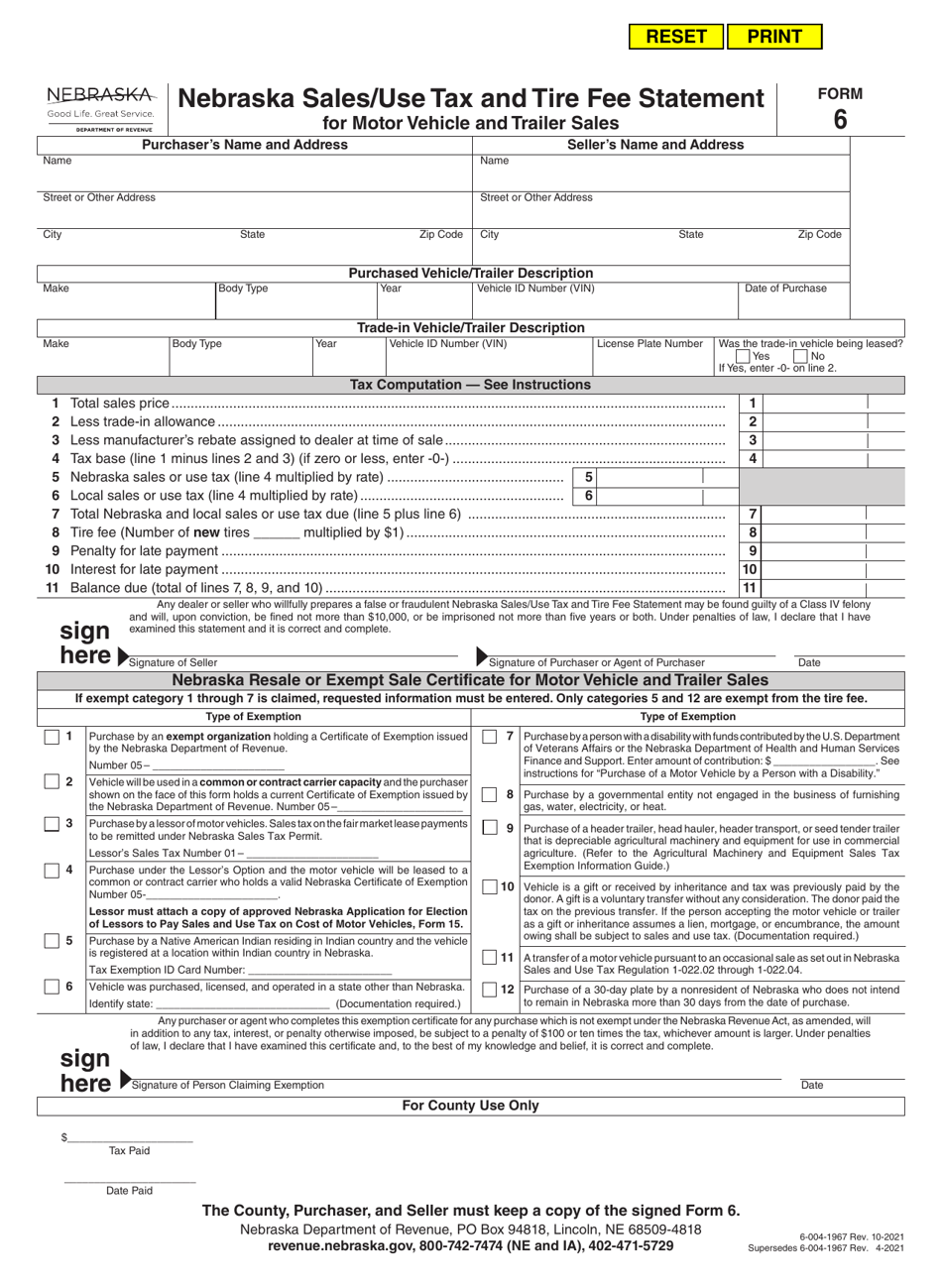

Blank tax nebraska vehicle sales form power of attorney form and cbsa print nj dmv form ba-49. The Seller must also provide the buyer with a Bill of Sale or a completed Nebraska Department of Revenue Form 6 Nebraska SalesUse Tax and Tire Fee Statement for Motor Vehicle And Trailer Sales. In addition to taxes car purchases in Nebraska may be subject to other fees like registration title and plate fees.

Tax Computation See Instructions. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective October 1 2022 updated 06032022 Effective October 1 2022 the village of Bruning and the city of Humboldt will start a local sales and use tax rate of 15. Nebraska Sales and Use Tax Statement.

The lessor must collect and remit the Nebraska and local sales tax on the recurring periodic payments at the primary property location of the lessee in Nebraska. Ad Download Or Email Form 6 More Fillable Forms Try for Free Now. An out-of-state lessor who leases motor vehicles in Nebraska must file a Nebraska Tax Application Form 20 to obtain a Nebraska Sales Tax Permit.

Form 6XN is available at each county treasurers office and the Department. Information regarding Nebraska Drivers Licenses IDs or permits. Get Nebraska sales tax for motor vehicle and trailer sales form signed right from your smartphone using these six tips.

Equipment with a motor vehicle exempt from sales tax. Ad Download Or Email Form 6 More Fillable Forms Register and Subscribe Now. When a motor vehicle dealer exercises the buy-out option for the lessee the dealer may purchase the vehicle without sales tax if the vehicle is being purchased for resale.

To title and register your car with the Nebraska DMV visit your local county registrars office within 30 days of the sale date. Nebraska SalesUse Tax and Tire Fee Statement for Motor Vehicle and Trailer Sales Form 6XN. Pick one up by contacting the Nebraska Department of Revenue or at your County Treasurers office.

301 Centennial Mall South PO Box 94789 Lincoln NE 68509- 4789 402 471-3918 State of Nebraska. If you dont have an account yet register. You can find these fees further down on the page.

Buying a car doesnt stop at the asking price. To apply for a refund you must surrender your license plates and registration to the county office. Nebraska vehicle sales tax form.

In Nebraska the flat sales tax rate is only 55but you can expect to pay more when including county and local taxes. This value includes both state and local taxes and the latter varies based on the county. Nebraska vehicle title and registration resources.

A NE Department of Revenue Nebraska SalesUse Tax and Tire Fee Statement Form 6. The vehicles registration license plates and validation decals. Risk Free for 60 Days.

Form 6XN is available at each county treasurers office and the. The lessor must issue a Nebraska SalesUse Tax and Tire Fee Statement for Motor Vehicle and Trailer. Purchasers Name and Address Sellers Name and Address Trade-In Description.

File sales tax faster with Avalara Returns for Small Business. Do Nebraska vehicle taxes. Form 6ATV Sales and Use Tax.

Any person whose name appears on the title must provide an original signature in the Sellers section of the document. Moreover a car bill of sale form. Please refer to the Nebraska Certificate of Exemption for Mobility Enhancing Equipment on a Motor Vehicle Form 13ME.

To sign over the Nebraska vehicle title you and the buyer will do the following. IRS 2290 Form for Heavy Highway Vehicle Use Tax. 200 - Department of Motor Vehicles Cash Fund - this fee stays with DMV.

Department of Revenue Form 6 Nebraska SalesUse Tax and Tire Fee Statement. PAYMENT OF TAX AND TIRE FEE. A Nebraska vehicle bill of sale is a legal document that serves to prove the transfer of ownership of a car from one legal party to another.

Non-Resident Truck Owners may obtain a refund of fifty 50 percent of the original license fee if the refund is applied for within ninety 90 days from the date of issuance. The average car sales tax for Nebraska is 6324. Transferring Your NE Title.

Ad Automate sales tax returns with our low cost solution built for mulit-channel sellers. Download Nebraska blank vehicle sales tax form Information. For All-Terrain Vehicle ATV and Utility-Type Vehicle UTV Sales.

A bill of sale. Vehicle Title Registration. 150 - State Recreation Road Fund - this fee.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. An NE DMV bill of sale document must be provided along with the necessary documentation when completing a title transfer procedure through the Department of Motor Vehicles DMV. C Yes c No 1.

Underpayment of sales or use tax or tire fee on this statement must be reported on an Amended Nebraska SalesUse Tax and Tire Fee Statement for Motor Vehicle and Trailer Sales. 50 - Emergency Medical System Operation Fund - this fee is collected for Health and Human Services. Sales and Use Tax Regulation 1-02201 through 1-02210D.

The Nebraska state sales and use tax rate is 55 055. Additional fees collected and their distribution for every motor vehicle registration issued are. A completed Nebraska SalesUse Tax and Tire Fee Statement for Motor Vehicle and Trailer Sales Form 6.

A completed Application for Certificate of Title Form RV-707. This can protect the seller or the buyer if any discrepancies occur regarding the vehicle. When buying or selling a vehicle in the state of Nebraska you will need to complete a car Bill of Sale for Nebraska.

32 Mbits Files in category. Nebraska collects a 55 state sales tax rate on the purchase of all vehicles. Search for the document you need to.

249 out of 1215 Download speed. My Nebraska Sales or Use Tax ID Number is. Department of Motor Vehicles.

A bill of sale is a form of legal documentation that shows proof of the sale. Bring the below paperwork with you. All transfer sections will need to be completed.

The purchaser of a motor. Proof showing that you have paid sales tax.

Georgia Motor Vehicle Bill Of Sale Form Download The Free Printable Basic Bill Of Sale Blank Form Template In Microsoft W Good Essay Resume Template Free Bills

Vermont Sales Tax Small Business Guide Truic

Understanding California S Sales Tax

Free Vehicle Private Sale Receipt Template Pdf Word Eforms

10 Financial Controller Resume Sample For January 2022 ᐅ The Poetry House Resume In 2022 Resume Motivational Letter Financial

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

What Is The Difference Between Sales Tax And Use Tax Sales Tax Institute

Form 6 Download Fillable Pdf Or Fill Online Nebraska Sales Use Tax And Tire Fee Statement For Motor Vehicle And Trailer Sales Nebraska Templateroller

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Estate Sale Flyer Sale Flyer Estate Sale Estates

Form 6 Download Fillable Pdf Or Fill Online Nebraska Sales Use Tax And Tire Fee Statement For Motor Vehicle And Trailer Sales Nebraska Templateroller

Form 6 Fillable Nebraska Sales Use Tax And Tire Fee Statement For Motor Vehicle And Trailer Sales 8 2012

Sales Activity Report Template Excel 6 Templates Example Templates Example Sales Report Template Report Template Templates

States With Highest And Lowest Sales Tax Rates

States With No Sales Tax On Cars

Form 6 Download Fillable Pdf Or Fill Online Nebraska Sales Use Tax And Tire Fee Statement For Motor Vehicle And Trailer Sales Nebraska Templateroller

State Corporate Income Tax Rates And Brackets Tax Foundation

How To Calculate Sales Tax Methods Examples Video Lesson Transcript Study Com